Poll Reveals Growing Doubts Among Americans About Trump’s Economic Policies

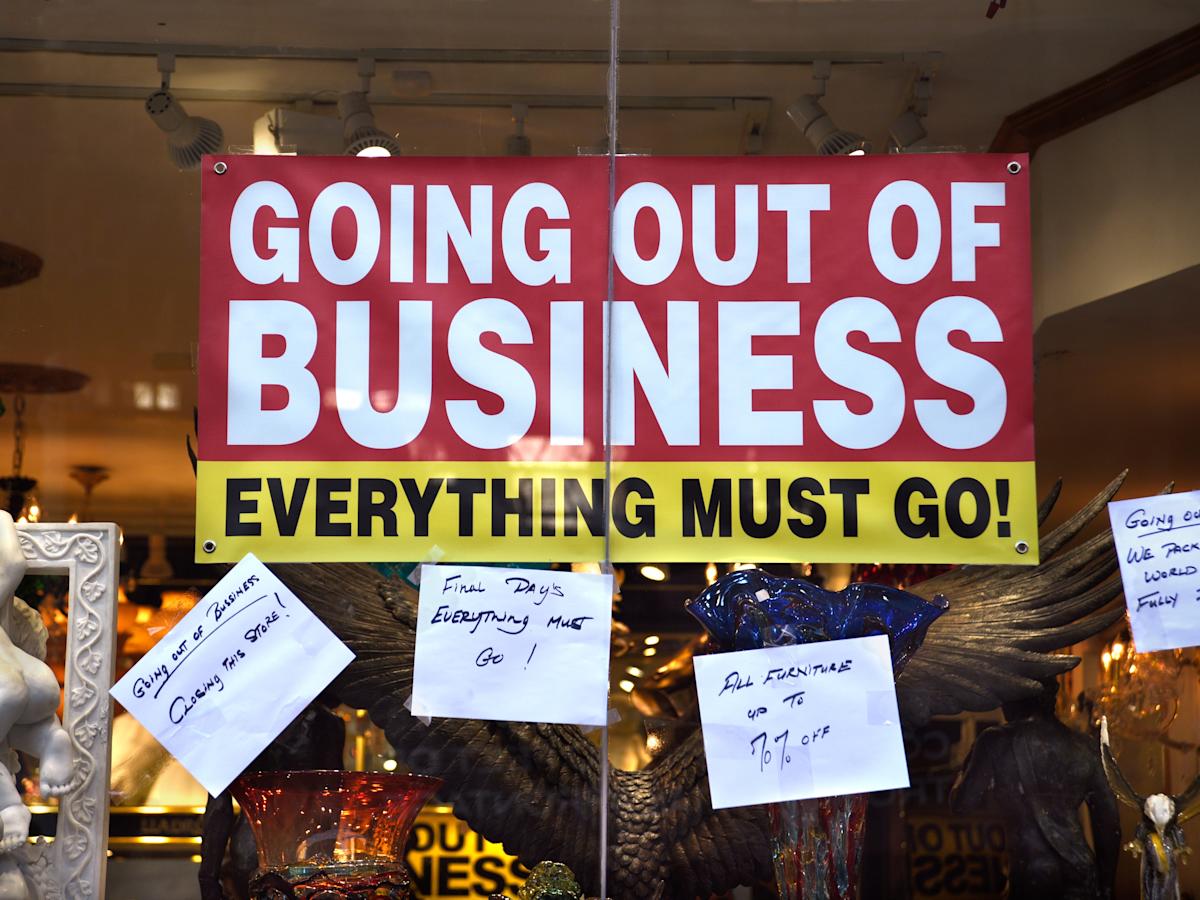

Concerns over a potential recession and rising prices are mounting among Americans, indicating a waning trust in President Donald Trump’s ability to strengthen the U.S. economy. Recent survey data highlights apprehensions surrounding the administration’s trade strategies and their broader economic impact.

A significant portion of the population fears the nation is being steered into a recession, with many attributing this anxiety to Trump’s broad and inconsistently applied tariffs. The poll conducted by The Associated Press-NORC Center for Public Affairs Research found that approximately half of U.S. adults believe Trump’s trade policies will significantly increase prices, while an additional 30% expect a moderate rise.

Moreover, around half of the respondents expressed extreme or very high concern about the possibility of the U.S. economy slipping into a recession in the near future. This unease persists despite the administration’s efforts to address inflation.

Despite the growing skepticism towards tariffs, it does not necessarily translate to a broad rejection of Trump himself. However, this cautious sentiment could pose challenges for Trump, especially among voters who promised voters he could quickly fix inflation.

Trump Faces Economic Approval Challenges Mid-Term

Three months into his second term, President Trump’s management of the economy and trade negotiations is emerging as a potential vulnerability. The poll indicates that roughly 40% of Americans approve of how the Republican leader is handling economic and trade matters, aligning with findings from an AP-NORC poll conducted in March.

Individual perspectives reflect this uncertainty. Matthew Wood, a 41-year-old unemployed resident of West Liberty, Kentucky, expressed his apprehension, stating, “I’m not a huge fan of it, especially considering China and going back and forth with adjustments on both ends.” Despite his concerns, Wood remains hopeful, willing to give Trump until the end of the year to demonstrate positive outcomes from the tariffs.

The opposition to tariffs has grown, with 52% of U.S. adults now against imposing tariffs on all imported goods, marking a slight increase from 46% in January, according to the poll findings up slightly from January. This shift is predominantly driven by adults under 30 who previously held no stance on the issue.

Janice Manis, a 63-year-old Trump supporter from Del Rio, Texas, shared her critique of the president’s tariff strategy, particularly the implementation of a partial 90-day pause for trade negotiations. She believes this pause weakened the U.S. position, allowing other countries like China to manipulate trade dynamics against American interests.

Mixed Economic Signals Amidst Tariff Policies

As President Trump nears the 100-day mark of his second term, the American public remains vigilant about potential economic fluctuations. While the economy shows signs of strength with moderating inflation and a healthy 4.2% unemployment rate, consumer confidence has notably declined.

Trump’s aggressive use of executive orders to reshape global economic relations includes imposing substantial import taxes, partially suspending some of them, and engaging in a trade war with China. These actions have led to volatility in financial markets, with stocks experiencing downturns and bond interest rates rising, increasing the cost of borrowing for mortgages, auto loans, and student debt.

The public sentiment largely views these tariff measures as excessive, with about 60% believing that Trump has “gone too far” in imposing new tariffs. This perspective is echoed by CEOs who are adjusting their earnings forecasts and seeking exemptions from the tariffs affecting allies like Canada and regions as disparate as penguin-inhabited islands.

Treasury Secretary Scott Bessent acknowledged the negative impact of tariffs, stating in a closed-door address that the situation with China is not “sustainable.”

Rising Concerns Over Living Costs and Financial Security

The economic apprehensions extend beyond tariffs, with approximately 60% of U.S. adults expressing significant worry about increasing grocery prices in the coming months. Additionally, half of the population is highly concerned about the affordability of major purchases like cars, cellphones, and appliances. Despite these fears, fewer individuals are anxious about their ability to buy desired goods, indicating some resilience in the economy.

Financial security remains a pressing issue, especially concerning retirement savings. About 40% of Americans cite their retirement funds as a major source of stress, while only around 20% are primarily worried about the stock market.

Nicole Jones, a 32-year-old occupational therapy student from Englewood, Florida, encapsulates the broader frustration: “This whole tariff war is just a losing situation not only for the American people but everybody worldwide. It’s revenge — and everybody’s losing on it.” She anticipates challenges such as losing financial aid and accumulating significant educational debt amidst rising costs.

Perceptions of the national economy vary along party lines. Republicans, who previously viewed the economy as struggling under Joe Biden’s presidency, now exhibit more optimism. In contrast, Democrats have grown increasingly pessimistic about the country’s financial trajectory.

Nicole Jones reflected on the economic conditions before Trump’s tariff policies, stating, “It wasn’t all sunshine and rainbows, but we were doing fine.”

The AP-NORC poll, conducted between April 17-21, surveyed 1,260 adults using NORC’s probability-based AmeriSpeak Panel to ensure a representative sample of the U.S. population. The margin of sampling error for adults overall is ±3.9 percentage points.