Tariff Uncertainty Clouds U.S. Electronics Trade Policy Under Trump Administration

The landscape of U.S. electronics imports is shifting once again as the Trump administration teases changes to existing tariffs. Consumers and businesses alike are left navigating a maze of potential tax hikes and exemptions that could reshape the tech market.

Last Friday, the Trump administration announced a temporary halt to new taxes on electronics entering the United States, offering a brief respite from the ongoing trade tensions, especially with China, a key supplier of gadgets like smartphones and laptops. Despite this pause, these electronic goods remain under the umbrella of existing tariffs.

U.S. Commerce Secretary Howard Lutnick clarified on ABC’s “This Week” that this exemption is only temporary. He indicated that electronics will soon fall under new, sector-specific tariffs targeting semiconductor products, expected to be implemented within the next couple of months.

Complicating matters, President Trump later asserted on social media that there would be no “exception” for electronics, suggesting that these items are merely being reclassified. He also maintained that China would continue to face a 20% tariff on electronics imports related to previous measures against fentanyl trafficking.

China’s Response to U.S. Tariff Adjustments

In response to the partial tariff suspension, China’s commerce ministry expressed cautious approval, advocating for the complete removal of U.S. tariffs. Chinese President Xi Jinping emphasized in an editorial that “there are no winners in a trade war,” urging both nations to protect the multilateral trading system and maintain stable global supply chains.

The trade conflict between the U.S. and China has intensified, with the Trump administration imposing tariffs that collectively amount to 145% on various Chinese imports since January. China has retaliated with its own tariffs totaling 125% on U.S. goods and has announced additional export controls on rare earth materials essential for high-tech manufacturing.

Implications for U.S. Consumers and Businesses

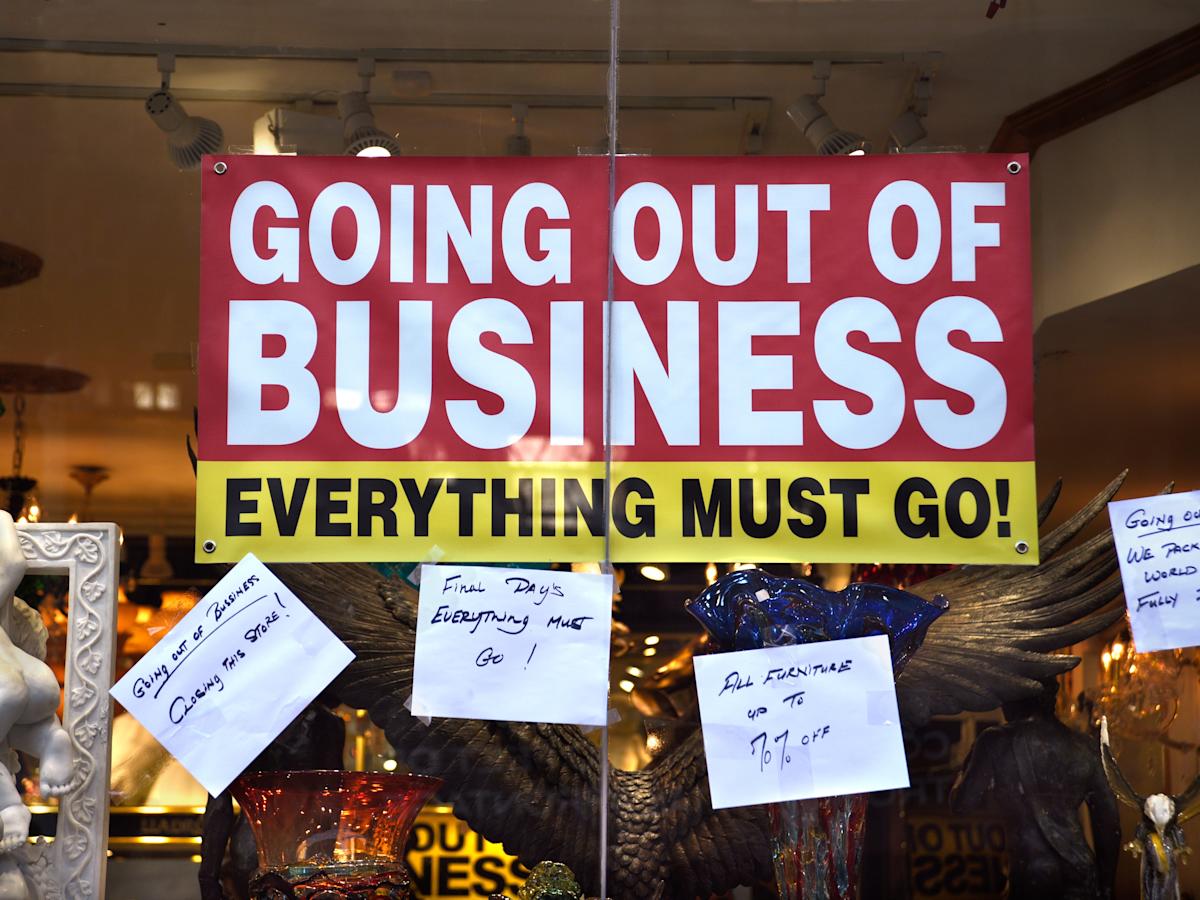

Economists warn that tariffs on electronics could lead to increased prices for consumers due to higher production costs embedded in global supply chains. Even with a temporary reduction in tariffs, ongoing and future levies are likely to sustain price pressures on items like smartphones and laptops.

Shifting supply chains in response to tariffs poses significant challenges. For instance, while the Trump administration hopes tariffs will motivate companies like Apple to manufacture more products in the U.S., the entrenched supply networks and substantial investment required make such transitions lengthy and costly.

Wendong Zhang, an assistant professor at Cornell University, highlighted the difficulty of achieving a “full decoupling between U.S. and China,” noting that nearly $174 billion in U.S. imports from China last year included critical components for electronics.

Additionally, President Trump indicated ongoing negotiations with industry leaders, stating he had “helped” Apple CEO Tim Cook regarding the partial tariff exemption and hinted at further temporary exemptions for auto manufacturers.

Market Reactions Amid Tariff Developments

Financial markets have experienced volatility due to the tariff uncertainties. Following the partial exemption announcement, major indices like the S&P 500, Dow Jones Industrial Average, and Nasdaq composite saw gains, although market stability remains precarious.

Experts like Dipanjan Chatterjee from Forrester emphasize the need for business stability amidst changing trade policies. The unpredictable tariff environment makes long-term planning challenging, with companies likely adopting cautious strategies to mitigate risks associated with fluctuating regulations.